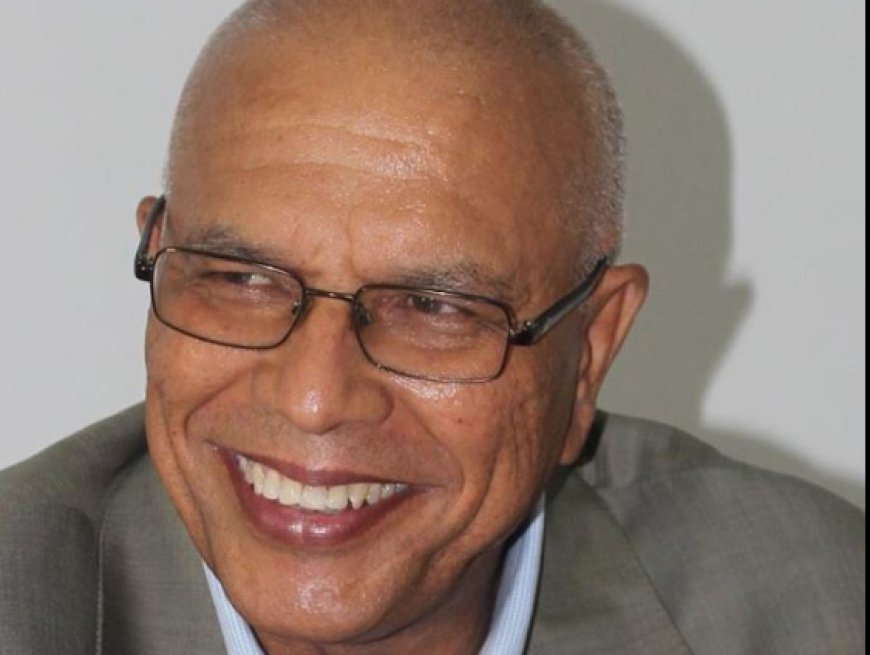

Bill to modernize the organic law of the Bank of Cabo Verde, challenges and contradictions, an analysis by former Governor Carlos Burgo

Recently, access was gained to the proposal to update the Organic Law of the Bank of Cabo Verde (BCV), a document that aims to modernize the regulatory and operational framework of the Central Bank, which, for more than two decades, has remained without significant changes.

The proposal comes at a time when developments in the supervision of financial institutions and the strengthening of the BCV's role as supervisor require an adaptation of its functions. The legislation in force dates back to 2002, the year in which the Organic Law was approved, and during this period, several changes have occurred in the Cape Verdean financial system, including the approval of the Law on Financial Institutions and Activities in 2014, which aimed to strengthen the role of the financial supervisor in the country.

One of the central points of the proposed revision is the strengthening of the BCV’s autonomy and transparency. The autonomy of central banks is a fundamental principle to ensure that their policies are adopted without political pressure and can be focused on the public interest, with the main responsibility being to guarantee the stability of the currency and the financial system. In this sense, the proposed law emphasizes the need to ensure that the capitalization of the BCV, carried out by the State, is increasingly automatic, avoiding delays and ensuring that the bank has the necessary resources to perform its functions properly.

Current legislation stipulates that the BCV must be capitalized within 60 days after notifying the Government of insufficient equity. The problem, however, does not lie in the law itself, but in its implementation. In recent years, the BCV has operated with a capital deficit that, according to the latest available information, reached approximately 1.6 billion contos in September 2024. This situation illustrates a critical gap between what is stipulated in the legislation and the effective fulfillment of these obligations. The lack of action by the Government and the BCV management has generated frustration, giving the impression that the laws exist more to be ignored than to be complied with.

Another important point in the proposal is the issue of financial transparency. The proposal suggests abolishing the BCV’s obligation to publish its financial and asset situation on a monthly basis, a practice currently required by the current Organic Law. This obligation has been an important oversight tool, allowing the Ministry of Finance to monitor the bank’s financial conditions and allowing the public to have access to crucial information about its financial health. With the elimination of this requirement, many see the setback as a serious risk to the transparency of the central bank’s operations, which could undermine public confidence in the BCV’s management.

The decision to suppress the publication of this information is not an isolated one. In recent years, the government has been less rigid in its compliance with this obligation. The lack of commitment to the disclosure of monthly financial information has fueled speculation and concerns, especially regarding the discovery of irregular transactions, such as those involving the Treasury, which were detected precisely through the publication of monthly balance sheets. These transactions, which were considered irregular and even illegal, resulted in reversals by the BCV administration following public and international pressure, particularly from the IMF. However, the major problem is that, to date, the memoranda detailing these transactions have never been made public.

The Challenge of Implementation and the Credibility of Reforms

The proposal to modernize the BCV’s Organic Law, although well-intentioned, raises important questions about the implementation of reforms and the effectiveness of the laws in the country. The technical and comprehensive nature of the proposal suggests an attempt to adapt the BCV to the new requirements of international financial supervision, but the lack of compliance with past obligations and the possible weakness of transparency suggest that the country needs to first take a step back to ensure that existing laws are effectively complied with.

Criticism of the lack of action in enforcing the current law is not just a matter of technical compliance, but of a broader concern about the effectiveness of the financial system and confidence in the institutions that govern the country’s monetary and financial policy. Without genuine implementation of the reforms, any legislative change will be seen as just another failed attempt, undermining the credibility of the BCV and the financial system in Cape Verde.

The path towards modernizing the Organic Law of the Bank of Cabo Verde is a necessary and urgent process, given the evolution of the financial system and the need to strengthen the autonomy of the central bank. However, the proposal, despite its merits, brings with it significant challenges, especially regarding transparency and the effectiveness of the reforms. The commitment to implementing and enforcing the laws, combined with the creation of an environment of greater transparency and oversight, will be essential for the proposed changes to actually result in a more robust and reliable financial system for the country. Society and financial agents will have to closely monitor the developments of this proposal, pressing for an implementation that not only meets legal requirements, but also builds the confidence necessary for sustainable economic growth in Cabo Verde.