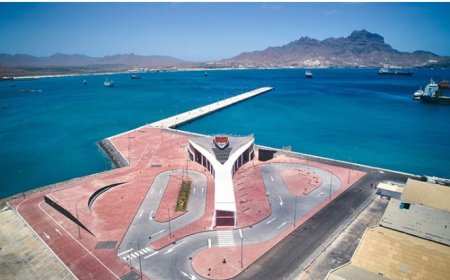

Brexit and Thomas Cook's bankruptcy threaten Cape Verde's growth

The director of the African department at the financial rating agency Standard & Poor's said today that Brexit and the bankruptcy of tour operator Thomas Cook could affect Cape Verde due to its dependence on tourism.

The director of the African department at the financial rating agency Standard & Poor's said today that Brexit and the bankruptcy of tour operator Thomas Cook could affect Cape Verde due to its dependence on tourism.

“Cape Verde is vulnerable to a slowdown in the growth of the European economy due to the concentration of European tourists and, for example, a terrorist attack or a volcanic eruption can put an end to GDP growth” (Gross Domestic Product), said Ravi Bhatia, in statements to Lusa.

In the week that the Lusa agency is holding a conference on the future of Cape Verde's economy, the analyst in charge of the African department explained that the country's main challenge is "to grow quickly and not be too dependent on tourism, fishing and aid and external financing”.

The main challenge is, however, also the main advantage, since Ravi Bhatia listed to Lusa that the main added value, from the point of view of analyzing the quality of sovereign credit, is the good tourist offer, with the proximity to Europe and potentially to Brazil and the United States, and also the vast fishing rights that the country has”.

Asked about the high level of public debt, whose ratio exceeds 100% of GDP, Ravi Bhatia downplayed the issue, recalling that sovereign debt management “has improved and the debt-to-GDP ratio has been falling, with the Government and take on less debt”, and added that “the majority of the debt is concessional”, that is, held by multilateral financial institutions that charge lower interest rates and longer repayment periods than those practiced in commercial banking.

In the latest S&P report on the country, which results from the analysts' visit to the archipelago in August, the financial rating agency, which assigns a 'rating' B, that is, speculative level or below the investment recommendation, with Perspective of Evolution Stable, predicts a growth of 4.9% until 2022.

“Currently, the risks to growth are mainly related to a slowdown in the number of tourists, and the Government is working to reduce the very high debt burden, anticipating modest progress until 2022”, reads the report that summarizes the S&P's opinion on Cape Verde's sovereign credit quality.

“We estimate that public debt will be 106% of GDP at the end of this year, which is high globally and one of the highest among the African countries we analyzed”, point out S&P experts, noting that the large increase since 2015 “ mainly reflects the Government's extensive investment program, which is mostly financed by concessional long-term debt with very low interest rates of 1 to 2%”.