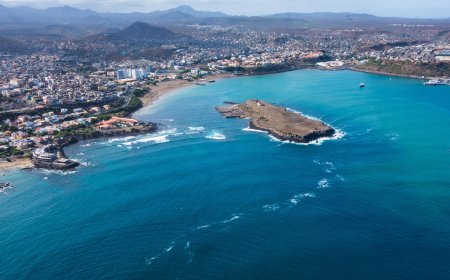

Notes on the 2020 State Budget

The Government's budget program is based on creative accounting with a focus on reducing the budget deficit due to captivation, GDP growth on the side of Consumption and Taxes, considering Other Net Liabilities of the State such as Acquisition of Assets, etc.

The Government's budget program is based on creative accounting with a focus on reducing the budget deficit based on captivation, GDP growth on the side of Consumption and Taxes, consider Other Net Liabilities of the State such as Acquisition of Assets etc.

It is a Budget to satisfy the addictions, the fascination of Governments and directors, to create an ecosystem of financing for companies with small players. That is, it is not an OE for the development of the country.

Debt

In a country that is allergic to transparency, the analysis focuses only on explicit budgetary responsibilities. The most worrisome are the expenditures that statistically do not enter directly (latent debts) in the public debt accounting. There are other implicit responsibilities, such as support for public companies, guarantees granted by the Government, other obligations arising from contracts with private parties, and contingent and perhaps hidden responsibilities. During the opposition, endorsements and guarantees to public companies were criticized. Now not only do they give to public companies, they also give to their private ones on behalf of the ecosystem . The Establishment Agreement with private individuals helps complete entrepreneurship à la carte.

The myth of privatizations as a way to reduce fiscal risk is only statistically valid. Because, from the moment the state subsidizes, gives endorsements and guarantees to privatized companies, it is contributing to the increase in debt. If these companies fail to comply, the State will have to assume these responsibilities. This type of mechanism, which creates perverse incentives, violates all government promises in terms of pursuing sound fiscal policies and implementing structural reforms at the national level. According to the OE 2020 (page 316-stock guarantees and guarantees), “stock of the debt guaranteed by the state amounted to CVE 13,361 million on 12/31/2018.” The total stock of contingent liabilities is always increasing.

According to Economist Carlos Burgo, “in the program agreed with the IMF under the Policy Coordination Instrument (PCI), the Government assumed that the State's borrowing needs would increase to 6.5% of GDP in 2019 because of retrocession loans (1.5 % of GDP), TACV restructuring costs (1.9%) and financing to municipalities (1%). First of all, it should be noted that the size of these below the line operations relativizes the importance of the budget balance as an indicator of budgetary management , all the more so since, to a large extent, these operations , in accordance with the most recent rules of public accounts, should not be accounted for as financial transactions, but as State expenditure.”

That is why, according to the 2018 report by the Banco de Cabo Verde [i] , “State financing costs have increased, from an average value of 2.2 percent in 2018 to 2.9 percent in 2019, with greater recourse to domestic debt and an increase in Treasury bill placement rates from 0.79 to 1.00 percent.

budget balance

The budget balance corresponds to the difference between income and expenditure. “The statistical designation is “net borrowing or net borrowing” or net borrowing (+) and net borrowing (-).”

The budget deficit (referring only to general government) for 2020 is CVE 3,569,407,253 (30 million euros). This means that expenditures are higher than revenues on the line than they have nominally been in recent years. At the percentage level decreased.

captivation

“The application of captives essentially seeks to control the dynamics of expenditure growth, not its reduction.”

In the OE 2020, the government once again emphasizes its strategy. This time, hiding the percentage of captivation and in what. The Government says: The “monthly monitoring of budget execution, aimed at adopting the necessary measures to comply with the fiscal deficit, the primary balance and the public debt, via a mechanism for adjusting expenditure captions , in order to compensate for any negative deviations identified in the recipe, in view of what was initially safeguarded in the previous point.”

The Government's mitigation measure is not to reduce Expenses, quite the contrary. From 2016 to 2019 there was an increase of more than 170 million euros. Current expenditure is captivated, creating a false decrease in the deficit. Statistically or artificially the deficit lowers. But the bill to pay is there. It's just a delay in accounting for expenses or payment.

GDP growth

In line with the last 3 years, economic growth was determined, on the supply side , above all, by the dynamics of the public sector (taxes net of subsidies and public administration ). Public Administration contributed 26.3% and taxes contributed 14% to the 5.7% growth. Together, they contributed 40.35% to GDP growth in the 1st half of 2019.

The Government's economic model is based on a credit economy supported by a Ponzi system, which stimulates consumption. It is an unsustainable growth, because instead of creating conditions for people to save to finance production, consumer credit is financing the economy, and not the creation and production of wealth, in the broadest sense . The government is encouraging exacerbated consumption, through a camouflaged tax effort by Citizens, with the slogan : Ecosystem Credit.

Taxes

Existing taxes in Cape Verde:

Income Taxes

A) IR - Corporate Income Tax (IRPC);

The IRPC rates are 25% (twenty-five percent) for taxable persons falling under the organized accounting regime, and 4% (four percent) for those falling under the simplified regime for micro and small companies.

B) IR - Personal Income Tax (IRPS).

The tax rate applicable to income subject to aggregation and taxation of manifestations of fortune is: a) Exemption up to $220,000 (two hundred and twenty escudos); b) 16.5% for annual earnings of up to 960,000$00 (nine hundred and sixty thousand escudos); c) 23.1% for annual earnings greater than PTE 960,000 (nine hundred and sixty thousand escudos) and up to PTE 1,800,000 (one million, eight hundred thousand escudos); d) 27.5% for earnings greater than $1,800,000 (one million eight hundred thousand escudos).

Withholding tax: 5 categories: A to E.

Consumption Taxes

a) Value Added Tax ( VAT ): 15% .

b) Special Consumption Tax ( ICE ): 10%.

c) Stamp Duty.

C) Single Tax on Assets (IUP): 1.5%.

Taxes on International Transactions

a) Import Duties

b) Tourist Contribution

c) Ecological Tax

d) Other Miscellaneous

Neoliberal distributive justice: The Government, in the Policy Coordination Instrument (PCI) agreement, has accepted that it will adopt the IMF proposal to increase VAT to 17%. In the proposed law for the State Budget for 2020 , under the heading of tax reform, it is explicit that the Government will resort to “taxation based on consumption and not on income”. In other words, it means that the government will make goods and services more expensive. When based on regressive taxation disregarding the contributory capacity (income), the highest income, not originating from work, will remain at the minimum value. The cost of living for the poorest will increase, since indirect taxes on consumption ( VAT, ICE and IS) fall more heavily on those who earn less and who use almost all of their income for consumption .

Millions of contos are spent on travel and accommodation, rent, fuel and communications, sacrificing the poorest.

Export

According to INE, Export comprises [i] :

a) Goods produced in Cape Verde;

b) Nationalized goods, i.e. imported goods, placed at the free disposal of importers after having been liquidated for any rights to which they are subject or which have received transformation, repair or complement of labor by virtue of which they had admitted with temporary exemption.

c) National and nationalized goods intended for foreign shipping.

Of the 7,059,779 Million CVE Exported, [ii] 5,773,075 Million CVE are related to fish. It remains to be seen whether they are goods produced in Cape Verde or national and nationalized goods destined for foreign shipping?

How many companies exported (how many people are employed), and what percentage remains in Cape Verde?

[i] http://ine.cv/wp-content/uploads/2019/07/boletim-das-estatisticas-do-comercio-externo_2otri_2019-00000002.pdf

[ii] http://ine.cv/quadros/exportacao-mercadorias- Segundo-classificacao-do-sistema-harmonizado-sh-as-seccoes-capitulos-do-sh-paises-destino- Segundo-classificacao-as-seccoes -do-sh-2018/

Samilo Moreira - Santiago Magazine